tax identity theft examples

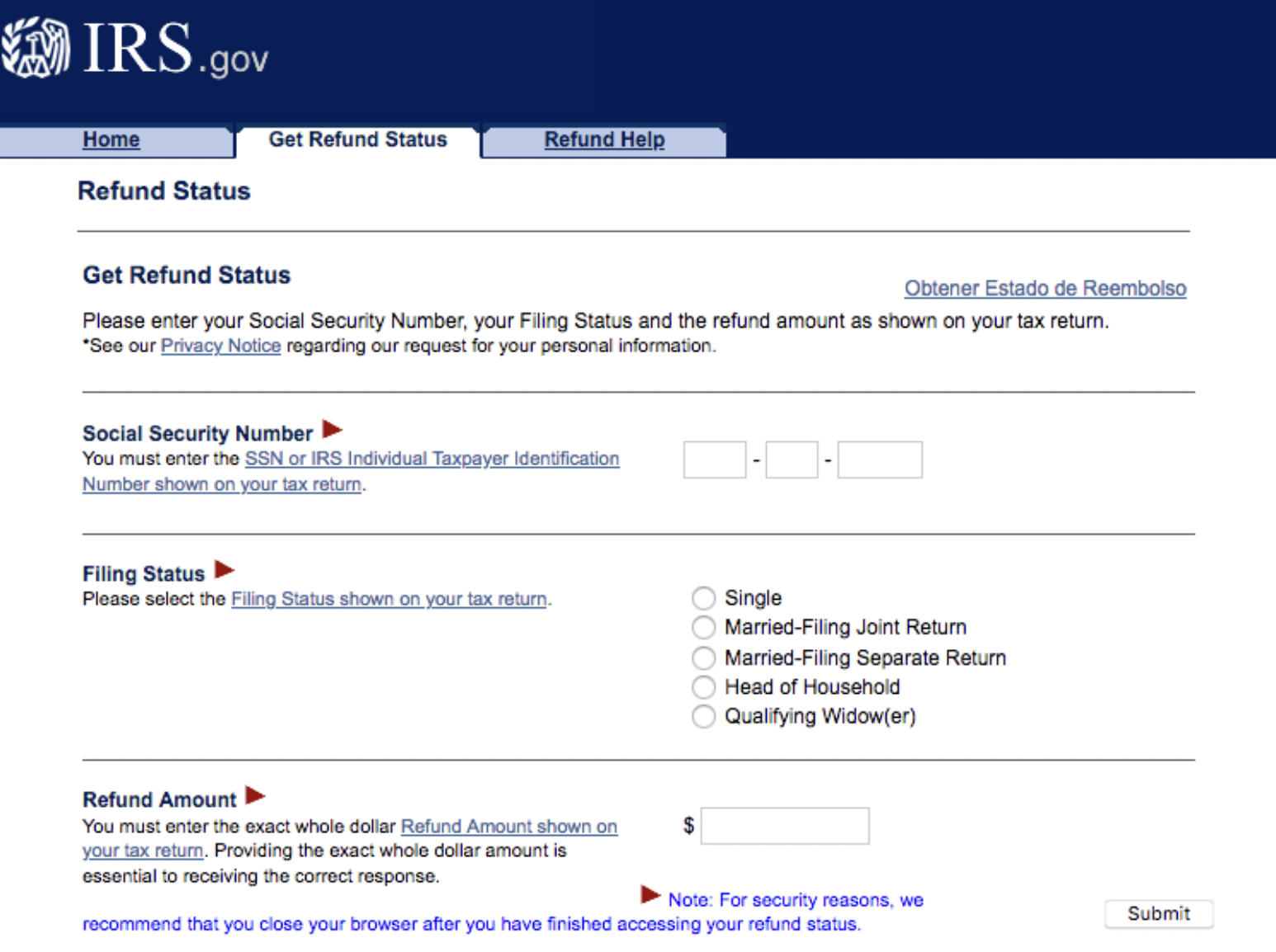

Tax Fraud Identity Theft Examples. Identity thieves may file taxes using your SSN and date of birth to cash in on your tax refund channeling it into their.

Tax Identity Theft.

. One example is tax-related ID theft or tax refund fraud. The fraudster files tax return paperwork in the victims name claiming a refund. Example of an identity theft crime.

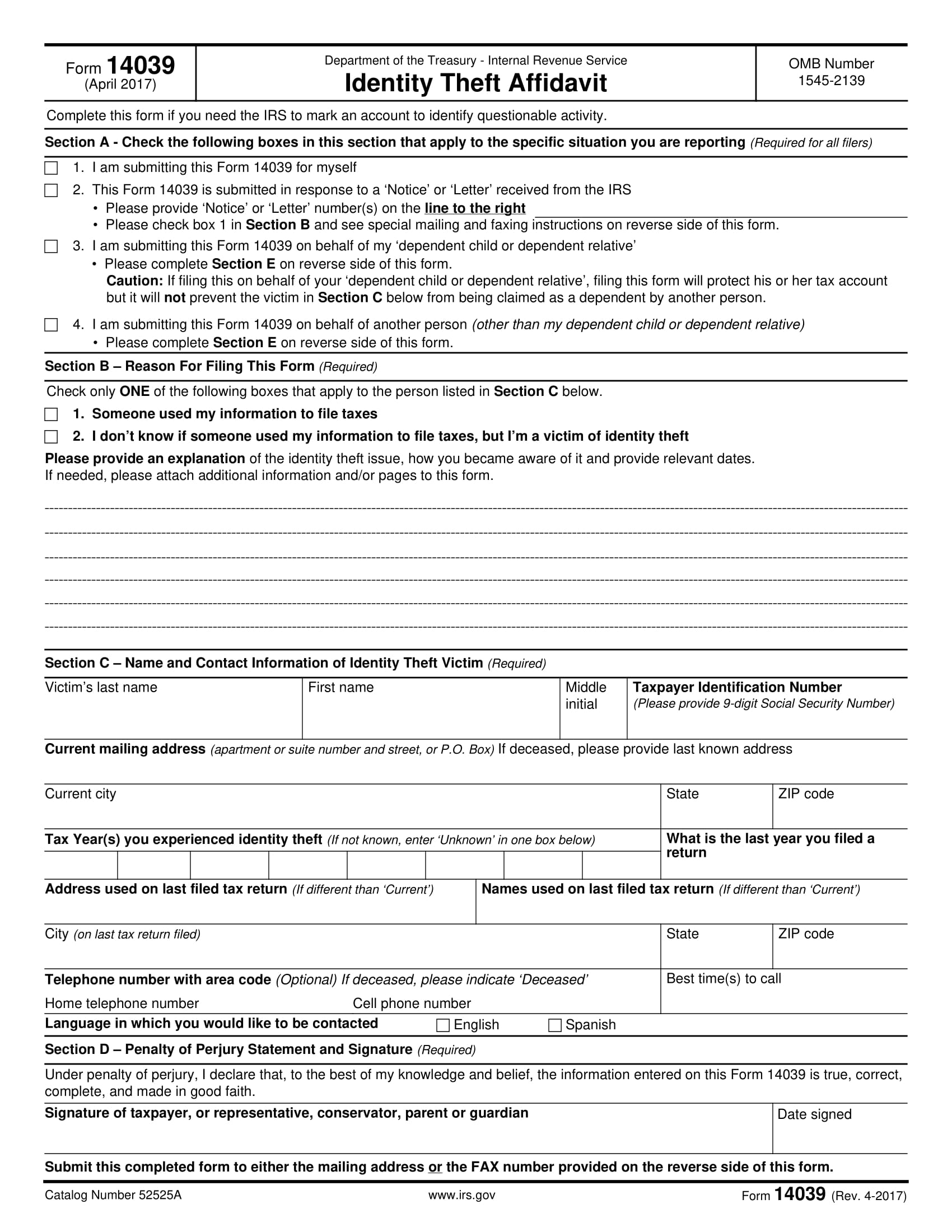

These include the use of phishing emails fake. Form 14039 Identity Theft Affidavit. This can also be the case when someone.

Identity theft is the act of stealing another persons personal identifying information in order to gain access to his financial resources or obtain access to. Complete Form 14039 Affidavit of Identity Theft. Using all 3 will keep your identity and data safer.

Examples of Identity Theft Crimes. Go on spending sprees using your credit and debit account numbers to buy big ticket items. Adults think its at least somewhat likely identity theft will cause them financial.

If someone else files a return using your SSN and the return is accepted you wont be able to e-file your return. Examples of signs of identity theft include receiving notices from the IRS on a variety of unexpected matters andwell known to tax preparersrejection of a tax return from. Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group Inc.

An Identity Protection Personal Identification Number better known as an IP PIN is another tool that you can use to combat tax-related identity theft. The description herein is a summary and intended for. Examples of business identity theft scams.

Once identity thieves have your personal information they may. Identity theft is an ongoing national crisis. There are a number of tactics identity thieves use to profit off your small business.

Passports and Drivers Licenses. The IRS issues a refund to the fraudster. According to a recent AICPA survey 48 percent of US.

This type of identity fraud happens when someone uses your personal information including your Social Security number to file a tax return in your name. Tax Identity Theft. One early sign that your SSN may soon be used by an ID thief involves receiving a notice from the IRS informing you that a new online account was just.

Call the IRS phone number provided on the notice. Identity thieves are continually creating new scams to utilize business information to their financial advantage. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that.

The form is downloadable from the IRS website irsgov and you can type. Recognizing tax ID theft. Although the overall number fell.

This is commonly seen in cases of tax identity theft when someone files a tax return in another persons name before they file their own. The IRS is only concerned with tax-related Identity Theft which is defined as occurring when someone uses your stolen Social Security number to file a tax return claiming a fraudulent. Examples of Identity Theft Investigations by IRS Natividad Mercado Medina a Mexican national 121 months.

Many of the same indicators that signify simple filing or. Recognize and avoid identity theft schemes. Identity theft related to tax administration.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number. In 2017 the IRS received 242000 reports from taxpayers reporting themselves as identity theft victims. An IP PIN is a six-digit.

An identity theft victim from Sarasota Florida realized she was a victim of identity theft when someone used her social security number to file taxes with the. Elizabeth Mercado Medina a Mexican national 108 months. Business identity theft is more complex than individual identity theft.

Tax Id What Is Tax Identity Theft And How To Protect Yourself From It Marca

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Irs Form 14039 Guide To The Identity Theft Affidavit Form

Someone Stole My Tax Refund Check What Should I Do

How To Protect Yourself From Identity Theft Money

Understanding Your 5071c Letter What Is Letter 5071c Community Tax

Identity Theft Examples In Real Life Fully Verified

What Is Digital Identity Theft Bitdefender Cyberpedia

Identity Theft Examples In Real Life Fully Verified

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

Tax Identity Theft American Family Insurance

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

How Common Is Tax Identity Theft Experian

9 Id Theft Affidavit Examples Pdf Examples

Types Of Identity Theft And Fraud Experian

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

What Happens After You Report Tax Identity Theft To The Irs H R Block

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)